How to Protect Your Finances from the Effects of Inflation

1. Save in a Diversified Mix of Assets

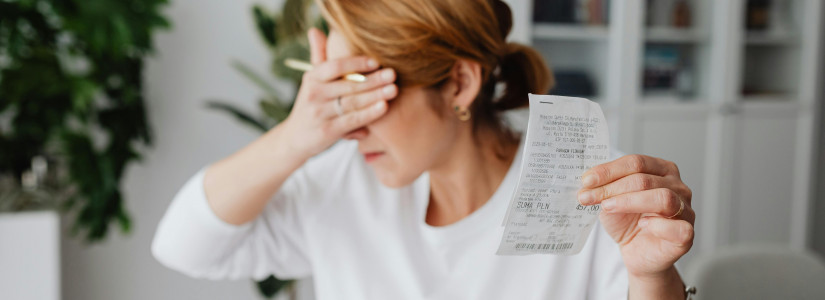

Over time, the cost of goods and services rises due to inflation leading to decreased purchasing power. As a result, each dollar you have today will buy less than it would have in the past. Saving in a diversified mix of assets is vital to keep up with the rising cost of living. Even if one asset suffers from inflation, you will still have other assets to fall back on. For example, you might invest money into savings accounts, bonds, and stocks.

2. Make Regular Contributions to Your Savings

When protecting your finances from the effects of inflation, one of the best things you can do is make regular contributions to your savings. Even if the dollar's value decreases over time, your savings will still be worth a significant amount of purchasing power.

Additionally, keeping your savings in a separate account from your checking account will avoid spending them on non-essentials. Rather than seeing your savings as "extra" money for impulse purchases, you'll view it as part of your long-term financial security and only use it when necessary. Remember to revisit your savings goals regularly and adjust them according to changes in inflation rates.

3. Invest In Inflation-Protected Securities

Inflation can majorly impact your finances, and protecting your money from its effects can be challenging. One way to do this is to invest in inflation-protected securities to keep pace with the rising cost of living. Inflation-protected securities offer higher interest rates than regular bonds and can be valuable to any investment portfolio. When inflation is low, the payments on these securities may not keep up with the rising cost of living. However, the payments can significantly boost your income when inflation is high.

4. Consider Using a Flexible Spending Account

5. Shop Around For the Best Prices

Inflation is a general increase in the prices of goods and services over time, which can significantly affect your finances as your money's purchasing power diminishes. It is important to shop for the best prices on the items you need to protect yourself from the effects of inflation. You can do this by comparison shopping online or in person at different stores. Additionally, you can look for sales and special offers to get the most bang for your buck. You can help to offset the adverse effects of inflation on your finances by being mindful of the prices of goods and services.

6. Invest In Yourself

Many people view inflation as an invisible thief, gradually stealing the value of their money over time. While it's true that inflation can harm your finances, there are ways to protect yourself from its effects, including investing in yourself.

Investing in your education and career can help you stay ahead of the curve, earning more money to offset the effects of inflation. Additionally, investing in your health can also pay dividends down the road. Taking care of your body and mind today will make you less likely to experience chronic health problems later in life, saving money and heartache.

Inflation has become a global crisis that deserves the attention of nations and individuals. While its effects can be devastating, the above tips can help you sail through before, during, and after an inflationary period. Be cautious in your investment to ensure you do not suffer significant losses, and always remember to seek professional help.

Related Articles

Stay ahead of the curve

Equip yourself with the knowledge to tackle inflation head-on, and access exclusive resources designed to help you thrive despite economic challenges.

Get Started